We're back with a second post in a series of quick consultations for our photography friends.

Those who may have an impressive portfolio but not yet a lot of in depth knowledge of innovative NFT strategies. The strategies that financially satisfy both the artists and the collectors.

And even more specifically, the strategies that build up value and reputation for collections by offering open editions.

What!? Open editions!? These are unlimited digital replicas of the original, often given out for free or low cost for a few hours or a few days.

Meaning: No scarcity at the start.

The exact opposite of what NFTs are all about!

But Guido Di Salle, Jack Butcher, and many others have used this counter intuitive strategy for maximum financial impact.

Turns out digital scarcity is not necessary if you have a solid strategy to create it.

How is that, you say??

Well, let's dive right in to the story of how Guido Di Salle's first open edition "Sicilian Kiss" photo became the de facto currency for his collectors;

how it started off as an unlimited open edition that soon became highly valuable;

and how he orchestrated a thriving art economy with his "Kiss" as the zero cost admissions ticket that then let his collectors co-create and shape the future of his entire oeuvre.

Guido Di Salle was known to be the controversial bad boy of fashion photography for the likes of GQ and Playboy before he ever minted his first NFTs.

So he did have some credentials and collectors at the start.

Then he foreshadowed the forthcoming "Kisses" art economy by announcing that collectors would have the ability to “burn” the "Kiss" in the future, thereby incentivizing collectors to buy more than one piece on the primary sale.

So he went to market with his bad boy brand, future burns, and of course the beauty of the "Kiss" all in his back pocket.

He could also legitimately claim that his first NFT drop would be the opposite of a cash grab since the "Kiss" had intrinsic value and yet was being given away for free (except for the network or gas fees)

The result? Over 10,000 people collected 14,812 of these digital gems in the five hours that the mint (primary sale) lasted (i.e. each person collected about ~1.5)

And the price soared to 0.03 ETH (~$55) the next day.

A month later, Guido revealed that collectors could exchange 10 Sicilian Kisses for his new "Meet Me & L'Estate" photo series.

A flurry of "Kiss" NFTs purchases ensued in order to gather the ten required to upgrade to the next set.

4,050 "Kiss" photos were exchanged or "burned" for 405 sets of "Meet Me & L'Estate" series.

And the price of the "Kiss" soared to 0.06 ETH (~$110).

Then came his genius masterstroke: there would also be future swaps for the "Meet Me & L'Estate" series, letting collectors upgrade once again.

Suddenly, it became clear to his collectors that this was more than a one-off experiment; it was a meticulously planned journey of art, engagement, and rewards.

As promised, Guido kept the more exclusive NFTs coming, and collectors kept playing the upgrade game.

As he let bundles of the "Kiss" and ""Meet Me & L'Estate" NFTs be exchanged for more limited editions, the supply of each previous existing edition dwindled, and prices soared.

Meanwhile, the new series had collectors salivating for their limited supply.

With almost 6,000 "Kisses" and 320 "Meet Me" editions swapped for new ones between November and January, Guido was on fire.

Then he dumped two more unlimited open editions "Monkey Business" and "New Year's Resolution, 2023" on the market, which kicked off their own unique edition games and art economies.

In just nine months, Guido's collection grew from two photographs to 28.

Critics worried that he was diluting the supply, but in reality, the opposite was happening.

This was Web3, afterall.

New work attracted new collectors and boosted awareness of Guido's editions.

As long as attention outpaced supply, there was a growing desire to continue to buy and burn his NFTs.

His ability to create scarcity over and over when at first there was none is a masterful example of how a long term strategy can create value for everyone involved.

In the end the total supply of all of his editions decreased, even for the once-free "Kiss" which saw its count drop by 40%.

In sum, what started as a free NFT became the currency of Guido's universe, shaping the future of his collection and turning collectors into co-conspirators, who were picking and choosing which art pieces they liked best.

Through a consistent, value creating, ability to churn and burn.

That also brought them the ability to take some profits off the table.

Even more well known than Guido, Jack Butcher of the blue "Checks" NFT fame also used this innovative open edition strategy to turn his Checks into a similar currency.

He originally sold 16,031 NFTs at $8 each during one 24 hour period. With this low priced open edition he was able to form a large community around his widely accessible artwork.

Then he used gamification tactics to make it vibrant.

He started by enabling his collectors to to burn two in exchange for a better (rarer) Checks artwork. Then he continued to play this game on and on, each new NFT more desirable than the last and requiring multiple more editions to be burnt to acquire it.

"..burning two 80-check pieces creates an artwork with 40 checks, burning two 40s creates a 20-check piece, and so on down the line, hitting benchmarks of 10, five, four, and ultimately resulting in a single colored checkmark artwork. "

As expected, demand and price points soared as the total circulating supply simultaneously went down.

While it appears to us here at Take It or Leave It that Jack's success leaned a bit too heavily on the gamification aspect (which might be hard to replicate in a down market) Guido astutely leaned on his iconic images as art worth collecting in their own right and the gamification aspect just resourced the attention required.

Which any aspiring NFT photographer could do.

In any case, since our snarky readers now know this playbook well, there's no need to go into too much detail about Jack. ;)

However we would like to bring up one more famous NFT photographer, who unintentionally also ended up following an open edition path to prosperity.

You might even know her, she is probably the most prolific, consistent, and successful NFT photog around: Cath Simard.

Way back in October 2017 she shared a photo of a Hawaiian road on her Instagram and it immediately went viral without attribution or compensation.

However, she then had what was probably the most creative epiphany of her entire career: instead of spending a lot of time and money chasing down people and sites to remove her copyrighted image, she would instead consider this a marketing coup of the highest order.

Afterall, this unintentional 'open edition' use of her image was making it famous with no effort on her part.

She then minted and sold the original as a 1/1 NFT, and released the rights to all the rest already out there in the world (netting her 100 ETH or ~303,481 at the time)

Kudos to Cath!

Just goes to show that creativity comes in all forms, both business and artistic.

Here at Take It or Leave It we would like to see more nascent NFT photographers succeed with this strategy.

While one might not have the force of personality of either a Guido or a Jack that helps get things jumpstarted, it still might make sense to offer an open edition of your best work for free for a few days in order to get the flywheel of fame spinning.

With the promise that collectors will always be able to burn a handful of the original edition for a more exclusive work in the future.

This creates your very own community of collectors from day one.

As well as something akin to a promissory note on your perceived future value.

So while we are not guaranteeing it will work, if nascent NFTers are going to offer their photos at today's (low) market prices, why not morph it into a community and a currency that creates fame and will be burned for future beauties?

We can't wait to hear in the comments if any of our snarky readers have already tried this!

And while the focus of this post is to show how to leverage open editions, the fact that Guido has achieved the highest level of success by leveraging this strategy again and again means that we are not ruling him out for all current and future projects, despite the fact that our personal tastes veer elsewhere.

Afterall, taste is subjective. But prices are not.

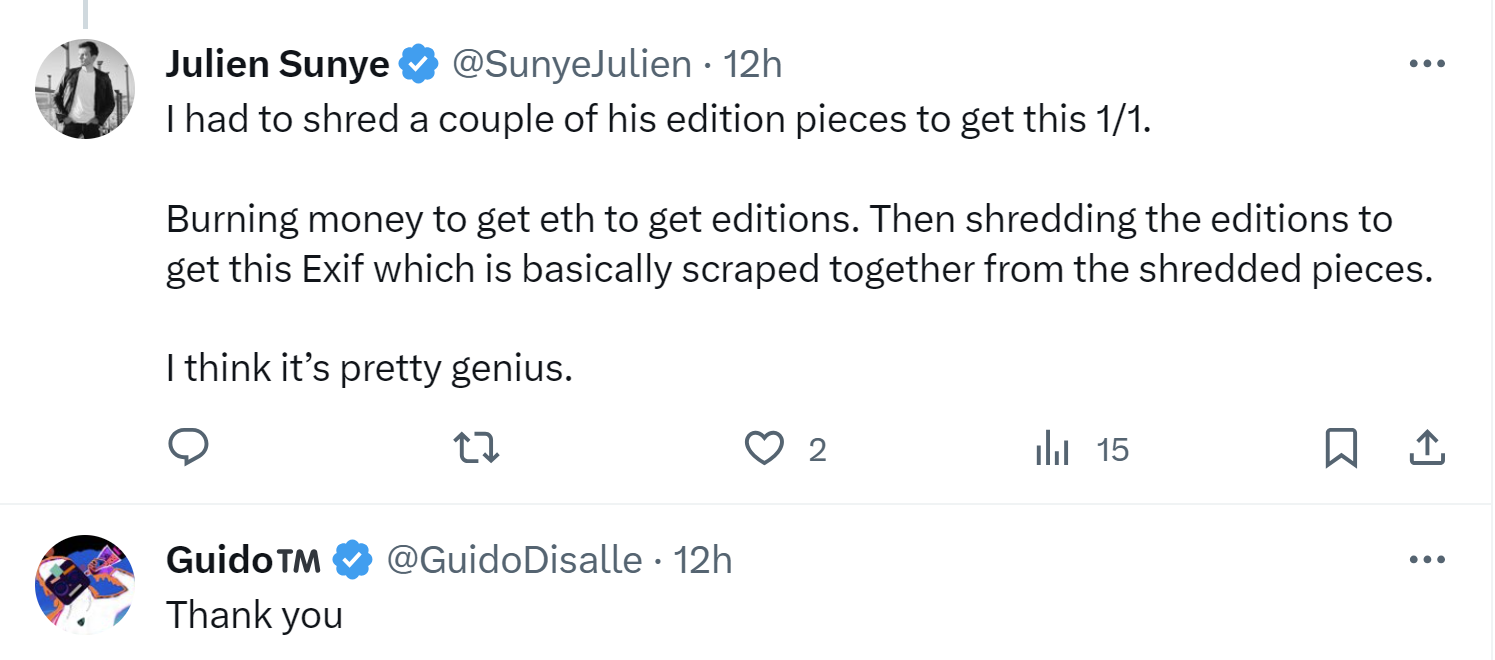

Currently he is promoting his new EXIF collection, which is actually an algorithmic re-mix of his earlier works and of course requires "burns" to acquire it.

We would probably give him at least a 50 percent chance of being able to do something as creative and successful as the "Kiss" economy again, maybe even more so now that he has increased global exposure for his bad boy brand and a plethora of happy collectors.

But then there is the bad press.

Not to mention the current bear market.

But since he has a shrewd gamification instinct, as well as an avaricious collector base, his EXIF NFTs still get a Cecily Score of 5/10.

It would be higher except that this type of algorithmic art tends to appeal more to the technocratic collector, and his collectors so far have been those that vibe with the provocative situations and bright lights of 1980s New York a la Helmut Newton.

Maybe there is a Venn Diagram somewhere that shows how big of a crossover there is between these two collectors.

But for the moment we will just have to wait and see the sales in order to find out.

He has 31.6K Followers on Twitter 30,500 followers on Instagram, and 514 on Discord.

Take It or Leave It?!

by Cecily Lough